OUR HISTORY

A strong democracy is founded on education for all. That's the vision that Thomas Jefferson held over 200 years ago. To make this ideology a reality, Jefferson proposed that land be reserved in each new state for schools.

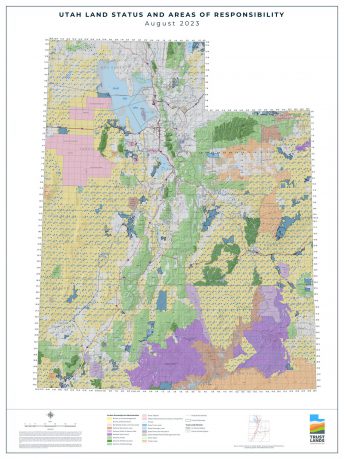

When Utah became a state in 1896, the U.S. Congress granted approximately six million acres of land to benefit public education in perpetuity. Since then, the management of these lands has raised approximately $2 billion (and counting) for Utah schools.

To further benefit our children, the Utah School & Institutional Trust Funds Office (SITFO) was created to optimize these funds. The state assembled a team of investment professionals with significant financial experience in both government and the private sector.

SITFO is united with the education community, legislature, and state government. Together, they fulfill Jefferson's vision by managing and growing revenue for Utah schools, opening the door for a future of well-educated, successful citizens.